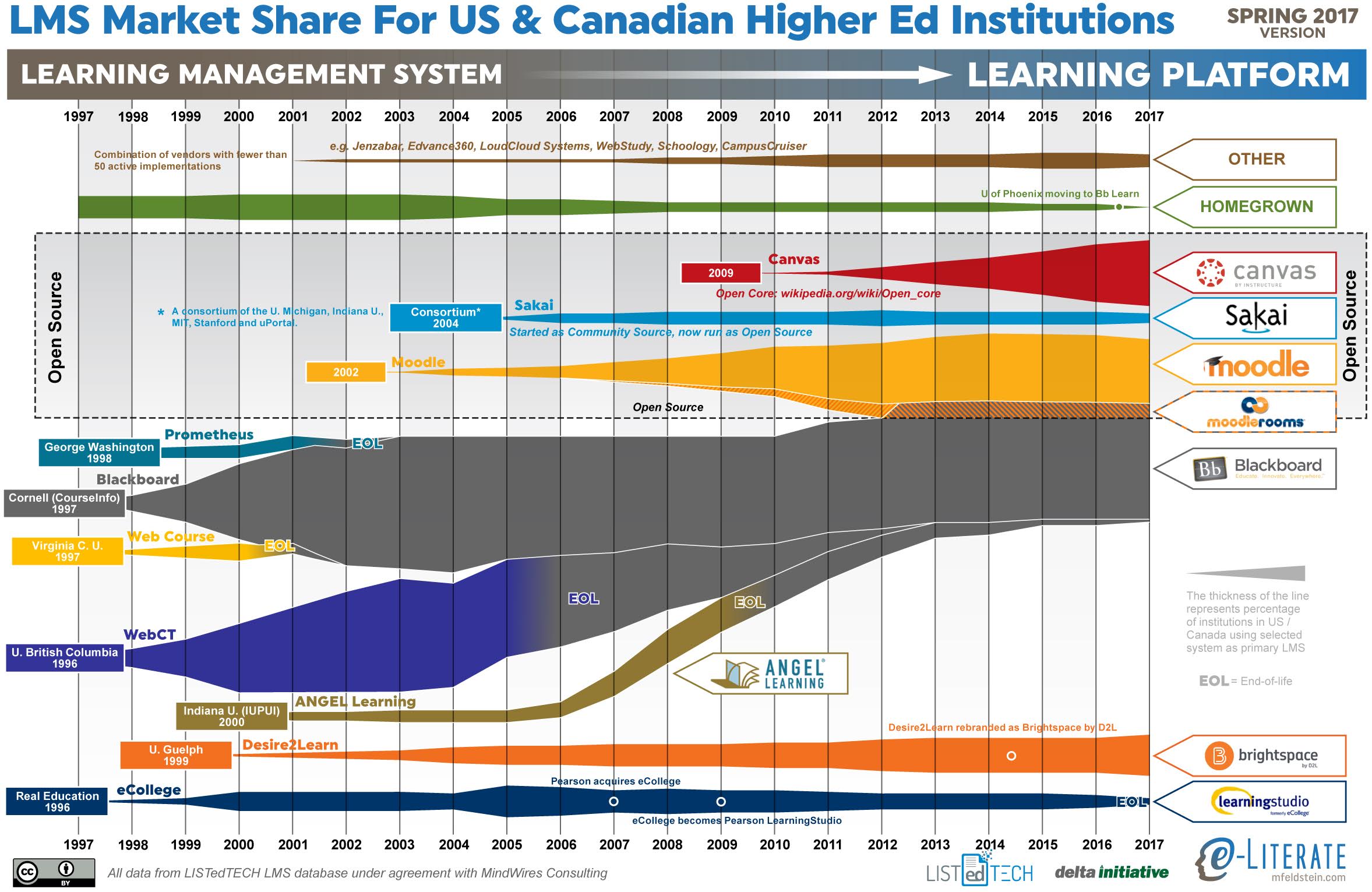

This is the ninth year I have shared the LMS market share graphic, commonly known as the squid graphic, for US and Canadian higher education. The original idea remains – to give a picture of the LMS market in one page, highlighting the story of the market over time. The key to the graphic is that the width of each band represents the percentage of institutions using a particular LMS as its primary system.

Last year we made a big shift based on our LMS market analysis service – we are working with LISTedTECH to provide market data and visualizations. This data source provides historical and current measures of institutional adoptions, allowing new insights into how the market has worked and current trends. Our spring report for subscribers will be released this month. Data for 2017 goes through April 1 of this year.

A few items to note:

- As has been true since 2012, the fastest-growing LMS is Canvas. There is no other solution close in terms of matching the Canvas1 growth.

- While we continue to show Canvas in the Open Source area, we have noted a more precise description as an Open Core model.

- Blackboard continues to lose market share, although the vast majority of that reduction over the past few years has been from customers leaving ANGEL. Blackboard Learn lost only a handful of clients in the past year. At this point ANGEL has is under 1% of market share.

- With the University of Phoenix move from a Homegrown system to Blackboard Learn Ultra, the band for Homegrown has dropped to less than 1% of institutions.

- Pearson’s has announced LearningStudio’s end-of-life for the end of 2017, and there are some big for-profit systems moving to D2L Brightspace and to Canvas. In fact, you can already see Brightspace increasing growth from past years based largely on former LearningStudio clients.

- There is a line for Other, capturing those systems with less than 50 active implementations as primary systems; systems like Jenzabar, Edvance360, LoudCloud Systems, WebStudy, Schoology, and CampusCruiser. Of these, Schoology is growing the most, primarily from smaller private institutions (their sweet spot). At this rate, Schoology may move to its own band by next year.

- It is interesting to reiterate that both Homegrown and Other categories have decreased over the past two years.

For a better description of the LMS market analysis service, read this post and / or sign up for more information here.

Update: Corrected description of Other category.

- Disclosure: Subscribers to our market analysis service include Instructure, D2L, Blackboard, Pearson, Schoology, and University of Phoenix. [↩]

[…] Source: mfeldstein.wpengine.com […]