This is a guest post from Jim Farmer, Chairman of Sigma Systems, Inc.

[Editor’s note: I have had this post from Jim for a while now and am only now getting a chance to publish it. Apologies to Jim and to you.]

On August 4th Hellman-Friedman LLC filed with the Security and Exchange Commission a planned press release announcing the merger of Datatel and SunGard Higher Education. The SEC filing did note the merger excluded the SunGard Higher Education K-12 Education business, which had been combined with higher education only a few months ago.

Hellman-Friedman LLC, a private equity firm, and partners own Datatel. Hellman-Friedman was offering $1.775 billion for the higher education part of SunGard Higher Education to create a merged firm..

SunGard Inc. acquired Systems and Computer Technology (SCT) in February 2004. In March 2005 SunGard Inc. itself was acquired by private equity firm Silver Lakes Partners.

At that time Campus Technology’s John Savarese summarized the issue:

In a financial world in which takeovers are often motivated by the desire to achieve economies through radical restructuring or cost-cutting, or where buyers purchase a company because they see the opportunity to quickly sell off assets, customers often have reason to be nervous. And higher ed customers have an added reason to worry: Running a university or college is not just another vertical market; successful software vendors have taken years to tune their offerings to the special needs and operating culture of the campus. Understandably, there is always the concern that new owners may not understand the importance of doing business in the native language of academe.

Another issue. On April 10th 2011 Peter Thiel—a co-founder of payPal, hedge fund manager and venture capitalist—said “We’re in a Bubble … It’s Higher Education.

Tech Crunch’s Sarah Lacy reported

Instead, for Thiel, the bubble that has taken the place of housing is the higher education bubble. “A true bubble is when something is overvalued and intensely believed,” he says. “Education may be the only thing people still believe in the United States.”

“Like any good bubble, this belief– while rooted in truth– gets pushed to unhealthy levels.”

A look at the numbers may suggest Hellman-Friedman alternatives.

Pregrin LLC reports the five-year private equity fund annualized earnings vary from 4.3% plus an equity for venture capital funding to 17.9% for buyouts. Private equity firms can leverage a buyout by obtaining a loan for part of the acquisition costs. For example, for a five-year buyout the private equity fund would need 15 – 20% to have comparable return. If only funds of private equity firm are used $317 million per year are needed from a revenue now of $541 million to yield a comparable return. With a 50% loan it is $205 million and at 20% $138 million. If SunGard Higher Education were as profitable as Datatel annual profit would be $108 million, almost enough to support a highly leveraged buyout. But price increases of 6 to 39% would not be unexpected.

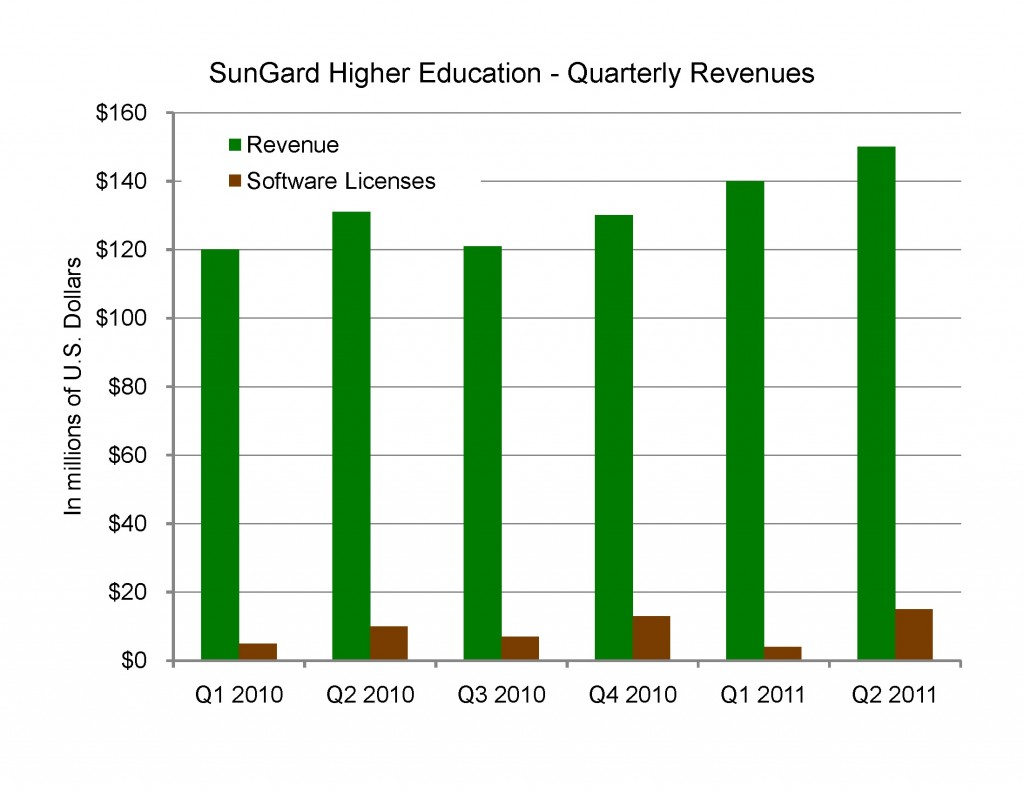

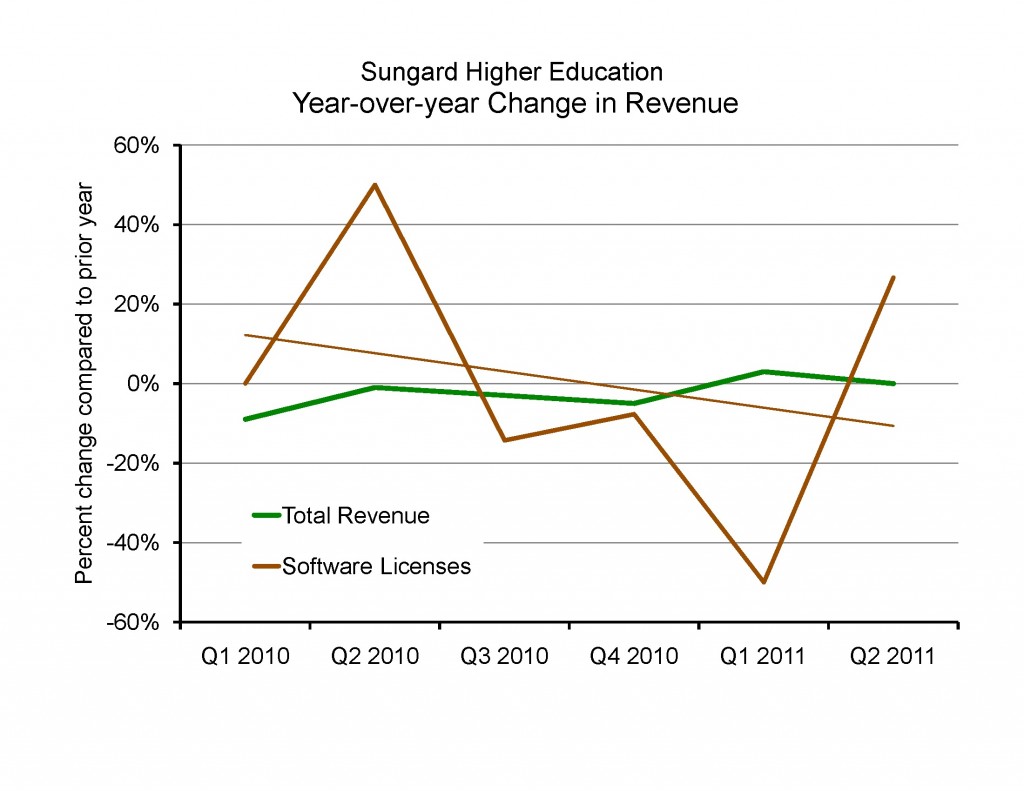

Market saturation can limit growth of revenue primarily to annual price increases for software maintenance. This is also evidenced by SunGard Higher Education’s very low or negative year- over-year increases in revenue. The option then is to increase software list prices (since annual maintenance is based on list prices) or increase the percentage or both. \—Oracle currently charges 22% of list price.

Financial data from Datatel is limited. However, in 2010 Datatel had revenue of $152 million. Software revenue increased 33% over 2009. Datatel CFO Kevin Boyce reported a profit of 20% for 2009—likely driven by the need to pay off the acquisition loan. By comparison Oracle’s profit margin—one of the highest for software companies—is 24%.

What does this mean for the user? Depending upon the patience of Hellman-Friedman it means a combination of cost reductions and price increases. The combination of increased list prices and increase of the percentage used annual maintenance could be significant for users.

Hellman–Friedman emphasized research and development focusing on the “major challenges” of higher education to build new software products (solutions). The increase in complexity of federal regulations may absorb any new resources. Many of the software suppliers had to rely on manual work-arounds at the campus for the 2010-2011 academic year due to their inability to implement the often-late regulations into software.

The SunGard Higher Education press release comments “The combined company will continue to invest in community and open source initiatives, online communities, and regional and national user group forums to foster collaboration and sharing of best practices.” For almost a decade Banner has used open source components ass is a way to reduce costs and to advance standards for interoperability. An alternative to reduce costs would be to team with open source projects. The availability or threat of open source software may limit price increases of software.

Perhaps the most reasonable advice given the history of acquisitions of software firms and the market share of the combined firms would be register for Kuali Days to see if there is a strategic alternative if needed.

[…] blog can be found at https://eliterate.us/the-datatel-sungard-higher-education-merger/ Category: Educational Software, eLiterate, Guest Blogs […]